INVEST FOR THE FUTURE

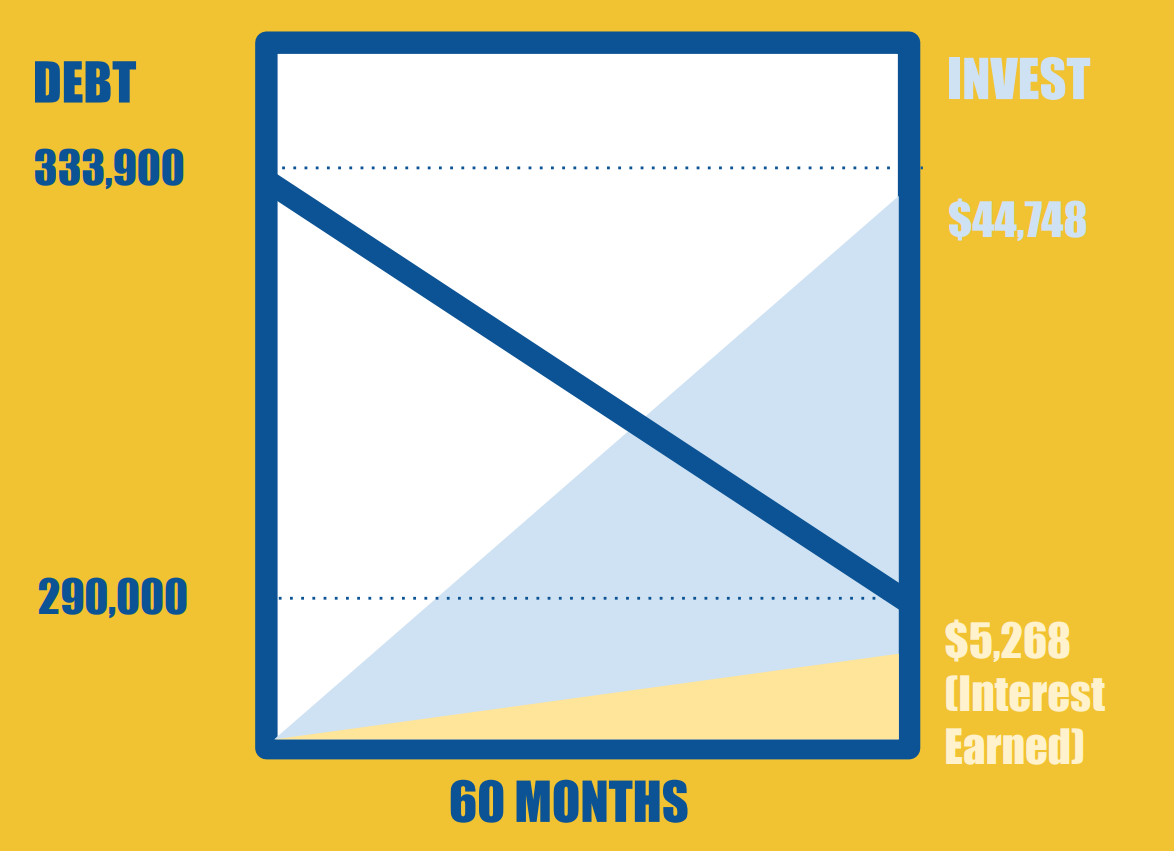

By reducing your interest expenses, you’ll have more cash on a monthly and annual basis and use those funds to invest for the future and see an even greater return.

Consider deploying your monthly savings towards renovations, investments in education or through regular contributions to a formal savings plan.

STEP 1

CONSOLIDATE YOUR HIGH INTEREST DEBT INTO A NEW

LOWER RATE MORTGAGE

STEP 2

REDEPLOY THE SAVINGS INTO A MONTHLY INVESTMENT PLAN

STEP 3

WATCH YOUR INVESTMENTS GROW, WHILE YOUR DEBT SHRINKS