Using the equity in your home can be an effective way to reduce your debt payments, improve your credit score and put cash in your hands quickly.

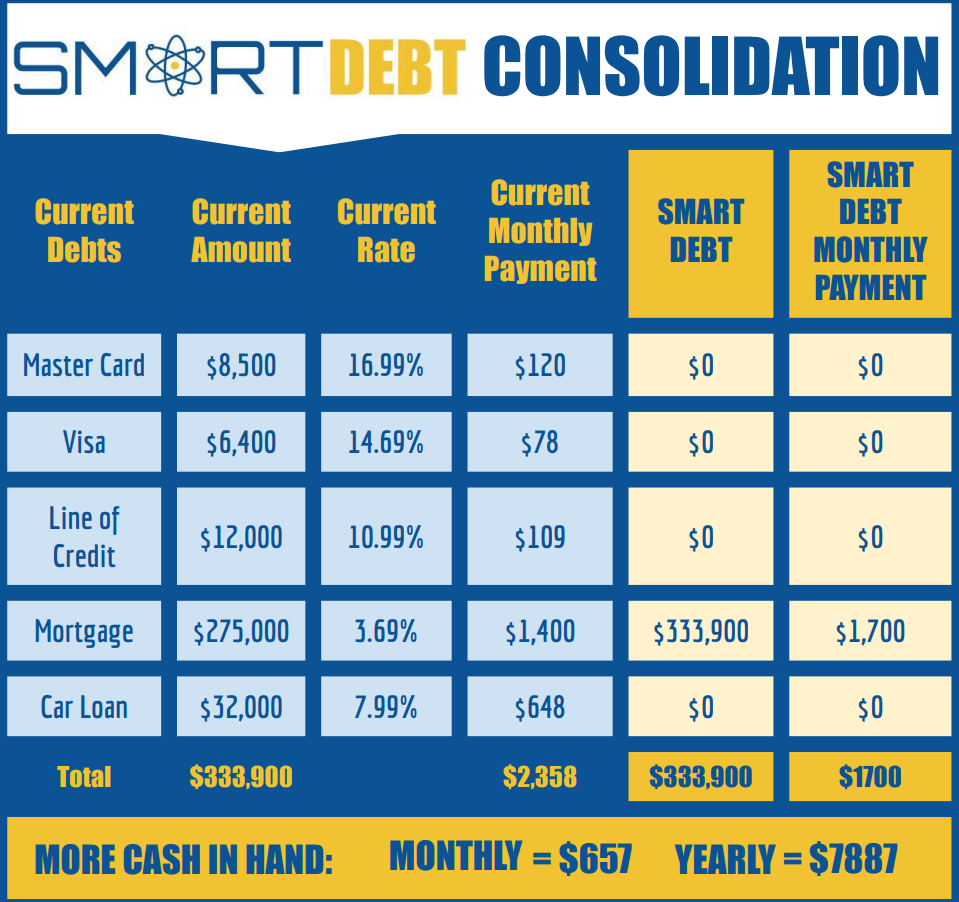

Consider the following example of a SMART DEBT Consolidation plan that frees up over $650 a month or almost $8,000 a year. Use the money for investments, renovations, your children’s education, a family vacation or simply to improve your monthly cash flow.

The above example is for illustration purposes only. Your results will be different and will depend on your unique situation.

BUILD YOUR SMART DEBT PLAN TODAY

REBUILD

CREDIT

PAY OFF

DEBT

INVEST FOR

THE FUTURE

GET CASH

NOW

REBUILD CREDIT

By consolidating your debts you’ll see improvements to your monthly cash flow and by reducing your unsecured debts, you’ll be well on your way to rebuilding your credit. An improved credit score can save you thousands of dollars in interest over the life of your mortgage.

OR

Let’s build a custom debt reduction and credit repair plan that will relieve the stress now and improve your score over time.

PAY OFF DEBT

If you own your home, you may be able to use some of the equity to pay off your high interest debt and save hundreds or even thousand of dollars a year on interest payments. With today’s interest rates near historic lows, it makes sense to use your equity to pay off your debts faster.

We’ve helped people like you to save hundreds of thousands of dollars interest and we can help too. We’ll review your unique situation and work with you to develop a plan to pay off your debt as quickly as possible.

INVEST FOR THE FUTURE

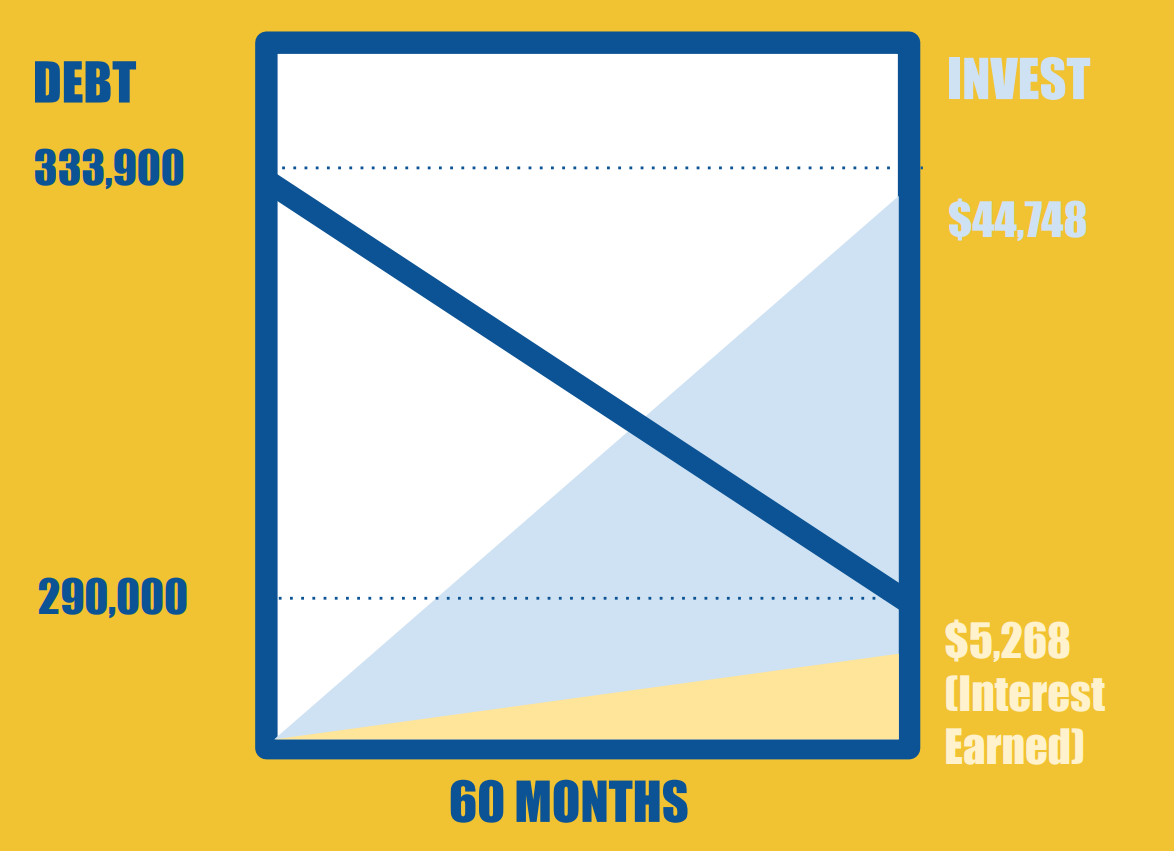

By reducing your interest expenses, you’ll have more cash on a monthly and annual basis and use those funds to invest for the future and see an even greater return.

Consider deploying your monthly savings towards renovations, investments in education or through regular contributions to a formal savings plan.

STEP 1

CONSOLIDATE YOUR HIGH INTEREST DEBT INTO A NEW

LOWER RATE MORTGAGE

STEP 2

REDEPLOY THE SAVINGS INTO A MONTHLY INVESTMENT PLAN

STEP 3

WATCH YOUR INVESTMENTS GROW, WHILE YOUR DEBT SHRINKS

The above example is for illustration purposes only. Your results will be different and will depend on your unique situation.